LAS VEGAS — Each January, employers, financial institutions, and government agencies issue key tax documents that residents need to file their federal income tax returns ahead of the April deadline.

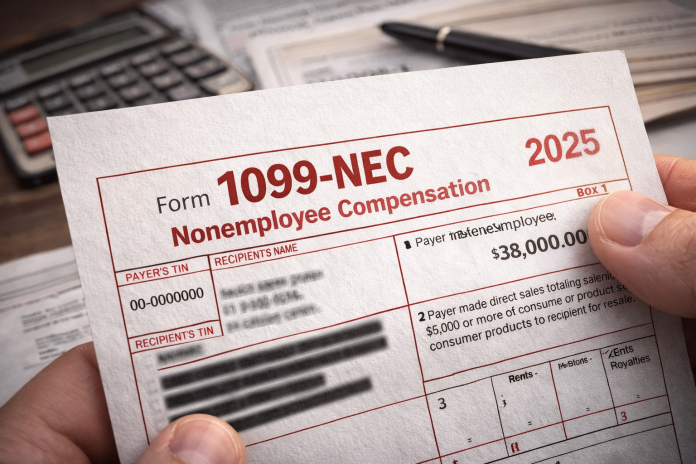

The end of the year is an essential time to start collecting tax documents from employers, banks, lenders, and investment firms. Residents should expect all income-related documents, such as W-2 forms for employees and 1099-NEC forms for self-employed or independent contractors, by Jan. 31, 2026.

Retirement-related documents, such as 1099-Rs, will also be issued. Residents who have begun collecting Social Security benefits will be provided with the SSA-1099 form in January. To avoid tax issues, employees are encouraged to contact the employer if they have not received the forms by February.

Residents can further avoid delays by verifying that all information on their forms is accurate, including names, Social Security numbers, and reported income amounts. The IRS is expected to open individual income tax return filing (Form 1040) by April 15, 2026.

Those expecting tax credits should start collecting all relevant paperwork, like 1098-T for education expenses, 1098-E for student loan interest, and records of charitable donations.